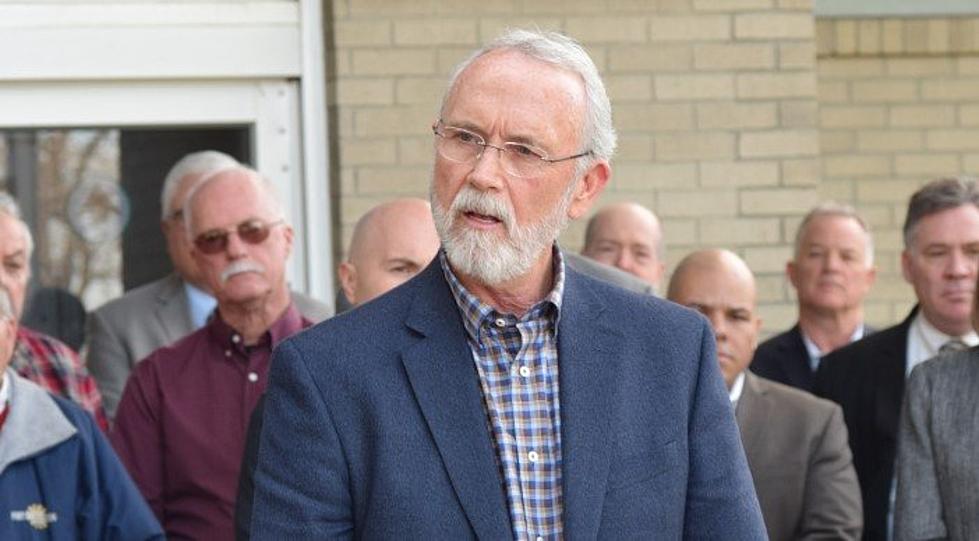

Newhouse: GOP Tax Proposal Should Be Good For Farmers

Republican House leadership rolled out several highlights of their proposed tax reform Thursday. While the details have not been laid out, Representative Dan Newhouse says for the most part the sweeping changes would be good for the ag industry. He said one of the key aspects is repealing the Estate Tax, an effort to help preserve businesses going from one generation to the next.

"We’re also accelerating the depreciation of equipment purchases, so you can fully write off the purchase a tractor in one year. And so that should do a couple of things, certainly stimulate the manufacturing of those pieces of equipment but also help the farmers be able to more fully afford those pieces of equipment that they need.”

Newhouse said they are also working to protect the ability to write off interest as an expense. He noted while House Republican have taken an extra day to unveil the details, he is confident the proposal will move forward.

“We’re still on track, we’re still on our schedule to be able to get this passed through Committee and on the floor before Thanksgiving and then through Congress by the end of the year,” Newhouse noted.

If you have a story idea for the Washington Ag Network, call (509) 547-1618, or e-mail gvaagen@cherrycreekradio.com

More From PNW Ag Network